“A new form of medical insurance” that returns unused premiums

Received the 2013 Nikkei Superior Products and Services Award for Excellence.

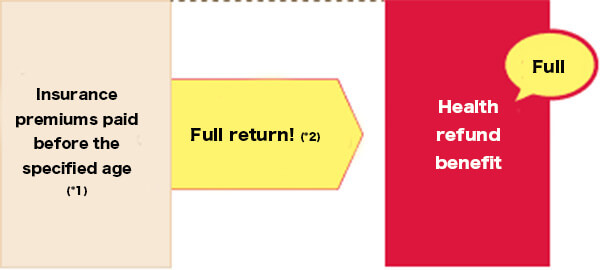

Feat.1 Return the unused portion of the paid insurance premiums!

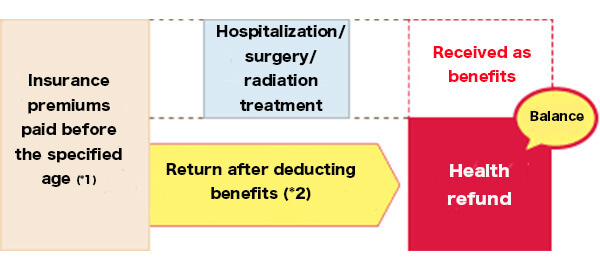

Insurance premiums (*1) paid before the specified age can be received as “health refund benefits” or “hospitalization benefits, etc.” (*2). If the total amount of hospitalization benefits, etc. received exceeds the insurance premiums paid, no health refund benefits will be received.

If you do not receive the hospitalization benefit, etc., the full amount will be returned. |

If you receive hospitalization benefits, etc., the difference will be refunded. |

|

|

📝If the insured person dies during the insurance period, if there is a surrender value in the contract for a type that does not pay a death benefit, you will receive the same amount of refund as this.

📝If you have a contract that pays a death benefit and die before the health refund benefit payment date, only the death benefit will be paid, and the health refund benefit and surrender value of the health refund special provision will be paid. there is no.

*1 The amount equivalent to premiums paid up to the day before the contract anniversary date in annual units when the insured person reaches the specified age.

Insurance premiums for various special contracts are not included. In addition, it is calculated assuming that no special provisions for exemption from payment of specified disease insurance premiums are added and death benefits are not secured. The prescribed age is 60 or 70 if the contract age is 0-40, 70 if 41-50, 75 if 51-55, and 80 if 56-60. increase. However, if an exemption from paying insurance premiums applies before the insured reaches the prescribed age, the amount equivalent to the premiums already paid up to the applicable date.

*2 When the insured person is alive on the date of payment of health refund benefits. Health refund benefit payment date refers to the annual contract anniversary date when the insured person reaches the eligible age for receiving the health refund benefit. However, if the reason for exemption from payment of insurance premiums has been met by the day before that day, the applicable day will be applied.。

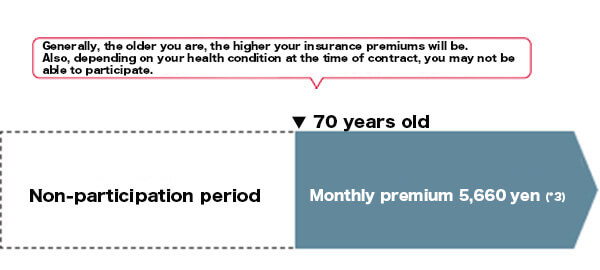

Feat.2 Reserve 1 for a lifetime medical coverage at a reasonable premium at the time of enrollment!

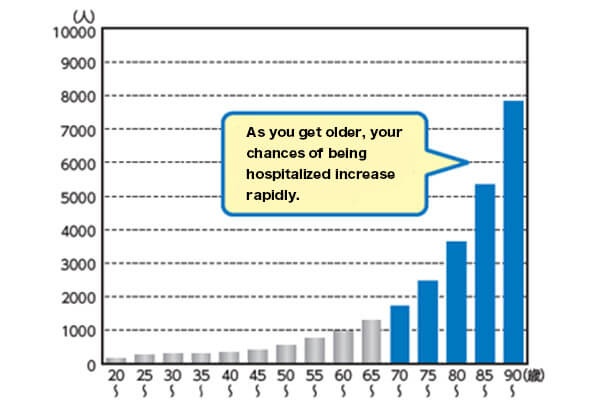

As you get older, your chances of being hospitalized increase rapidly.

You can continue your medical coverage at a reasonable premium at the time of enrollment when the probability of hospitalization increases.

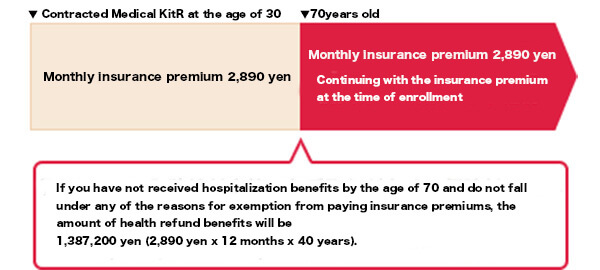

Example of Medical Kit R and our medical insurance (Medical Kit NEO)

Gender: Male / Daily amount of hospitalization benefit: 5,000 yen / Insurance period/Premium payment period: Whole life (account transfer treatment) / 60 days per hospital stay / Type of benefit multiplier for surgery and radiation therapy benefits: Type I /Death benefit payout ratio: 0 times (no death benefit)

If you join Medical Kit R at the age of 30[Recipient age for health refund benefits: 70 years old] |

When you join our medical insurance (Medical Kit NEO) at the age of 70 |

|

|

*3 Premiums for Medical Kit NEO (comprehensive medical insurance (basic coverage, non-surrender refund type)) as of August 2, 2022, and may change in the future.

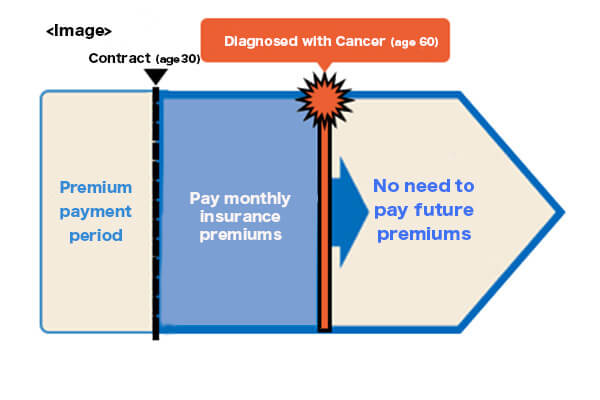

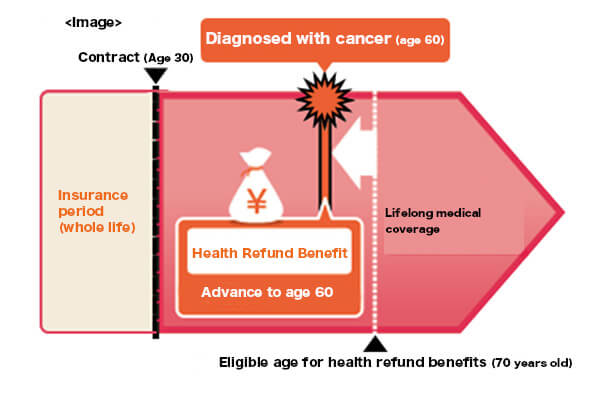

Feat. 3 When special provision for exemption from payment of insurance premiums for specified diseases is added You can prepare for the burden of insurance premiums when you become a specified disease!

If you fall under a prescribed condition due to a specific disease [malignant neoplasm (cancer), heart disease, cerebrovascular disease]

- No need to pay future premiums. What’s more, the warranty lasts for life.

- If you apply before reaching the age eligible to receive health refund benefits,

At that point, you will be able to receive the unused portion of the premiums you have paid up to that point (*4).

(The health refund benefit can be received only once during the insurance period.)

- ※4 Insurance premiums paid by the day of the event (regardless of the payment method, the premiums will be paid monthly or by bank transfer. Insurance premiums for various riders are not included. (calculated assuming that no special provision for exemption from premium payment is added and the death benefit is not secured.) will be deducted from the amount received up to that point, such as hospitalization benefits, etc., as a health refund benefit.

Example: Mr. A (60 years old, male) who was diagnosed with cancer during a health checkup

<Contract conditions> Age of contract: 30 years old / Insurance period/Premium payment period: Whole life / Eligible age for receiving health refund benefits: 70 years old /

Special provisions for exemption from payment of insurance premiums for specified diseases Addition/Death benefit benefit ratio: 0x (no death benefit)

|

|

Feat.4 You can secure death protection for the rest of your life at a reasonable premium just in case of an emergency. (If you meet the prescribed conditions and have a contract with a type that pays a death benefit)

The death benefit amount is calculated by multiplying the daily amount of hospitalization benefits by the death benefit payout ratio. (※5)

- The death benefit benefit rate can be set from 0x to 500x (in units of 50x) based on prescribed conditions. (*6)

- Premiums for the death protection portion are not eligible for health refund benefits (returns).。

- There is no cash surrender value for the basic protection portion, including the death benefit portion, throughout the insurance period. There is a cancellation refund for the health refund special part only before the health refund benefit payment date.

- The death benefit of this insurance does not have an asset formation function that utilizes the cash surrender value, and the cash surrender value cannot be used even if the contract details are reviewed in the future. Please be especially careful when signing a contract if the insured person is a minor.

*5 If the result of this formula is less than the surrender value of the health refund special provision, you will receive the same amount as the surrender value.

*6 The death benefit payout rate that can be set differs depending on the contract details. Please check with your dealer/distributor for specific conditions.

Feat.5 In addition to coverage for hospitalization and surgery, comprehensive coverage to meet customer needs!

Coverage selected by the customer (special contract) (partial)

|

|

|

|

|

|

|

For Customers Considering Insurance

Precautions when making a contract

Precautions when making a contract

This website provides an overview of our products. Before signing a contract, be sure to check the “Important Matters Manual” as there are notes that you should check before signing a contract.