F A Q

FAQ about “Total Assist Personal Insurance”

(New Comprehensive Insurance)

Click on the + to the right of the question to see the answer.

I lost my "policy" or "continuation certificate". Can you reissue it?

The “Certificate” or “Continuation Certificate” can be reissued.

Please contact “your policyholder’s agent” or “Customer Center” from the policyholder himself/herself.

The “Agent of Contract” is listed on the insurance policy (or renewal certificate), Total Assist Personal Insurance renewal information, etc., and on the My Page application.

I had a property damage accident (accident against property). Is it covered by Compulsory Automobile Liability Insurance (CALI) ?

The CALI policy covers only bodily injury and does not cover damage to property.

Please contact the insurance company that underwrites your voluntary insurance policy for property damage.

Please let me know the details of the Personal Liability Compensation rider.

This rider covers the legal liability of the named insured (the person who mainly uses the car insured under the policy) and his/her family members, etc., when they injure others or damage others’ property in their daily lives.

The policy pays out up to the insured amount for each accident. The amount of insurance is unlimited for accidents in Japan and 100 million yen for accidents outside Japan.

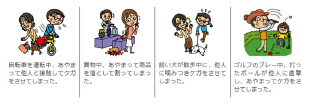

【Examples of coverage under the rider】

Please let me know who is eligible for coverage under the Family Motorcycle Special Clause of the automobile insurance policy.

The following persons (1) through (4) are eligible for coverage.

(1) Named insured

(2) Spouse of (1)

(3) Relatives living together with (1) or (2)

(4) Unmarried children of (1) or (2) living separately

For more information on the “Family Bike Rider”, please click here.

Family Motorcycle Special Clause of “Total Assist Auto Insurance

When is the date of account transfer (debit date) for premiums in the case of an account transfer contract?

In principle, the debit date is the 26th of each month, but some financial institutions may debit on the 27th. If the debit date falls on a Saturday, Sunday, or holiday, the debit will be made on the next business day.

In addition, the date of withdrawal may differ from the regular date of withdrawal for contracts with a special clause for group or collective treatment. Please check with your group or contracting agent.

The contact information of your contracted agent is listed on the insurance policy (or policy renewal certificate) and fire insurance renewal information.

If you do not know your contracting agent, please contact the Customer Center in person.

Does the fire insurance policy cover furniture, clothing, equipment, etc. in the building?

Coverage is provided for “household goods,” “equipment and fixtures,” and “merchandise and products” when such items are insured under the policy.

If you choose “Buildings only” as the subject of the policy, you will not be covered.

For details on the basic coverage of “Total Assist Home Insurance”, please click here.

I have an earthquake insurance policy. If my house is damaged by an earthquake or tsunami, how should I report the accident?

Accident reports are accepted through “My Page”, “Your agent” and “Accident Report Center (Tokio Marine & Nichido Anshin 110)”.

Can a company (corporation) be the policyholder of an earthquake insurance policy?

Both “corporate” and “individual” policyholders can purchase earthquake insurance.

However, please note that earthquake insurance is limited to residential buildings and personal property (household goods) for daily living (buildings used for business purposes, equipment and fixtures, goods and products, etc. are not covered). Please note that earthquake insurance coverage is limited to “household goods” only.

For more information on earthquake insurance coverage, please click here.

Is only the insured person covered by the "Personal Liability Compensation Rider"?

The Personal Liability Compensation rider, which can be contracted under Total Assist Body Insurance (fixed amount personal injury insurance), covers the following persons

(1) Named insured

(2) Spouse of (1)

(3) Relatives living in common with (1) or (2)

(4) Unmarried children of (1) or (2) living separately

How many days will the hospital visit benefit be paid from?

If you have a Total Assist Body Insurance (Fixed Amount for Personal Accident) or (Golfer) policy with “daily hospital visit coverage,” coverage will be paid from the first day of hospital visit.

*The coverage does not apply to hospital visits after 180 days have elapsed including the day of the accident.

*The maximum number of days of hospital visits per accident is 30 days.

Does medical insurance pay for surgery even if I am not hospitalized?

Surgical procedure insurance will be paid regardless of whether the patient is hospitalized or not.

*Depending on the type of surgery, there may be a limit to the number of times the surgery can be performed, or payment may not be made.

Is the diagnosis benefit of cancer insurance paid even if I am not hospitalized?

If a diagnosis of cancer is confirmed, payment will be made regardless of whether the patient is hospitalized or not.

Does medical insurance pay for surgery even if I am not hospitalized?

Surgical procedure insurance will be paid regardless of whether the patient is hospitalized or not.

Depending on the type of surgery, there may be a limit to the number of times the surgery can be performed, or it may not be covered.

This section covers Long-term Medical Insurance (Long Life Mini)*, Hospitalization Insurance (Long Life@Office)*, Medical Insurance* and Group General Life Insurance (Medical Insurance) purchased from the former Nichido Fire.

*We have stopped accepting new policies. Please be assured that we will continue to maintain and manage the policies we have already underwritten.

FAQ on Each Insurance Lineup

Click on the questions for more information.

-

Questions about Total Assist Personal Insurance (New Comprehensive Insurance)

-

Questions about Auto Mobile Insurance

-

Questions about Home Insurance

-

Questions about Death Insurance

-

Questions about Earthquake Insurance

-

Questions about Cancer Insurance

-

Questions about Medical Insurance

-

In case if accident be happened…

※For other inquiries, please contact Global Insurances Co., Ltd.